10 Simple Techniques For First Data Merchant Services

Wiki Article

The Best Guide To Payeezy Gateway

Table of ContentsPayment Hub - TruthsSome Known Questions About Payeezy Gateway.Square Credit Card Processing Things To Know Before You Get ThisExcitement About Square Credit Card ProcessingThe 30-Second Trick For Credit Card Processing Companies7 Simple Techniques For Fintwist SolutionsClover Go - Truths8 Simple Techniques For Credit Card ProcessingCredit Card Processing Fees for DummiesWhat Does Payeezy Gateway Do?Get This Report on Merchant Services

This is essentially a prebuilt gateway that can be personalized as well as branded as your own. Right here are some widely known white label remedies developed for merchants: An integrated portal can be a committed resource of earnings, as sellers that get all the needed compliance end up being payment provider themselves. This indicates your company can refine repayments for other sellers for a charge.are that you have complete control over the purchases at your internet site. You can customize your settlement system as you want, and also customize it to your company requirements. In situation of a white-label option, the settlement portal is your well-known modern technology. typically are everything about preserving the infrastructure of your settlement system and also the associated expenditures.

The Facts About Payeezy Gateway Revealed

Right here are some things to take into consideration before determining on a copyright. Research the rates Settlement processing is intricate, as it consists of several financial institutions or organizations. Like any service, a settlement entrance calls for a charge for using third-party tools to procedure and accredit the deal. Every event that joins repayment verification/authorization or handling charges costs.

The 8-Second Trick For Online Payment Solutions

Guarantee your item type is permitted by the provider Typically, there are two kinds of items thought about by suppliers: electronic and physical. Several of the settlement option suppliers use their solutions both for physical as well as digital items. But it's not unusual for just one sort of item to be offered in operation of a specific system.

Popular settlement entrance suppliers The horde of gateway suppliers is overwhelming, so we have actually chosen some of the most significant, most dependable options. Red stripe approves all major repayment approaches, including mobile settlement carriers such as Apple Pay, We, Chat Pay, Alipay, and also Android Pay.

Unknown Facts About Online Payment Solutions

Pay, Friend supplies scalable solutions for organizations of different dimensions. Via its gateway, Pay, Buddy uses handling of all the significant credit scores as well as debit cards, as well as Pay, Buddy repayments themselves, with different other methods.This is a safety and security procedure when we replace delicate information with symbols as it minimizes the opportunity of scams. Symbols have purchase information and also cardholder information, without exposing it to the 3rd parties. Become PCI DSS compliant by implementing all the necessary safety procedures as well as integrating merchant fraud protection devices on your internet site.

Some Known Facts About First Data Merchant Services.

Create a merchant management web application, or merely an admin panel to permit your team to regulate merchant procedures. You might also make use of open-source repayment portal services.And also if you are trying to find a means to improve client confidence, integrate a settlement option that will certainly motivate trust, assistance several repayment approaches, as well as be shielded from deceitful actions.

Facts About Payment Hub Revealed

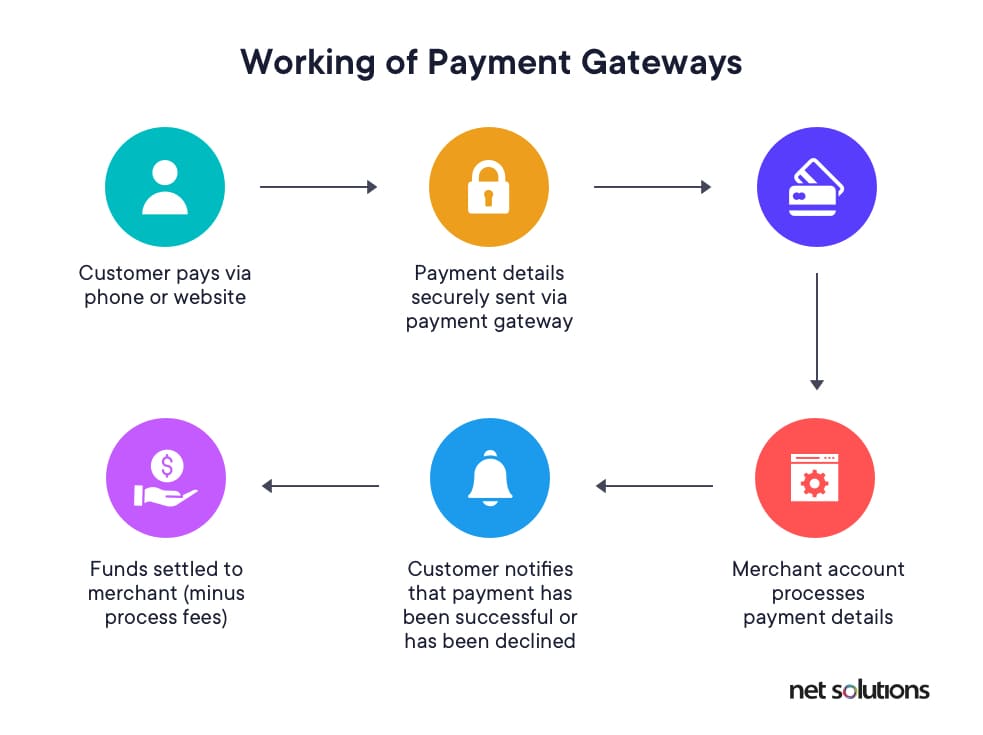

FAQs What Is a Repayment Entrance? At its core, a repayment entrance is software application that secures a consumer's credit report card details and sends it to the releasing bank for approval when they buy online or in a store. This transaction determines whether a consumer's acquisition is authorized or declined.If the purchase is accepted, the seller after that satisfies the order. The procedure normally takes simply seconds. Security is essential to payment portals. If consumers don't really feel that they can rely on the vendor taking their payment information, they may determine not to buy. Exactly How Much Do Repayment Gateways Price? A lot of repayment portals use purchase-based go to the website prices, with 2.

The Buzz on Payment Hub

Since deal rates can vary, it is necessary for sellers to pick both a vendor account and payment portal that supplies rates that will not reduce into their earnings margins. Just how We Picked the most effective Settlement Portals We took a look at over a lots repayment portals for this evaluation. At the top of our checklist were providers that used support for the most settlement kinds.Today we use mobile tools, not just for sending messages or obtaining telephone calls but likewise for ordering products or solutions and paying for them. Whether you want to construct a booking, event, or even a shopping app to process purchases you will need a mobile app settlement gateway.

Virtual Terminal Can Be Fun For Everyone

[In-app settlements procedure] All these stages take just a few seconds if the Net link is great. Now you can picture what is taking place when you spend for your orders online. At the very same time, you likewise see a clear photo of how vital settlement entrance safety is. Every secondly, a massive quantity of money and repayment info undergo settlement entrances.

9 Easy Facts About Ebpp Shown

By using In-App Payment API, you make it possible for customers to pay in-app with their App, Store or Google Play through Apple or Gmail accounts - virtual terminal. When you are offering services and products outside the app, both Apple and also Google suggest using third-party mobile settlement entrance providers. You can incorporate SDK as one of the existing in-app payment remedies to your application that will conduct all purchases with banks, secure client data, and be in charge of repayment deals.To empower your application with this feature, make use of the SDK of existing payment portals, such as Pay, Buddy, Braintree, or Red stripe. You can integrate the SDK by yourself or employ a development group that will certainly do like it all the combinations and also setups for you. Related write-ups:.

The smart Trick of Credit Card Processing Companies That Nobody is Discussing

It's difficult to remember what life resembled before mobile apps allowed us to pay friends or sellers with a few faucets. Whether it's person-to-person repayments or company deals, fintech innovations have actually made the way we move money around more practical than ever. Top Fintech Payment Firms to Know, Clover Network, Spot, On, Billd, Check out."Non-cash settlements have raised in volume because of the rise in adoption of electronic settlement services throughout all market sections," Christophe Vergne, cards and also payment method leader at Capgemini, told CNBC - credit card processing fees. The following fintech repayment firms are adding to this expanding trend while making processing repayments quicker, less complex as well as more protected.

3 Easy Facts About Online Payment Solutions Shown

Billd Austin, TX Billd is a repayment remedy for the building and construction industry that enables specialists to obtain the materials they need to complete a work as well as pay distributors over a time period. Providers are paid ahead of time by Billd before shipping any type of products to specialists while contractors have a 120-day term to pay their equilibrium, making it so cashflow never ever obstructs of approving extraordinary work.Report this wiki page